In today’s interconnected world, overseas funding has become a pivotal strategy for businesses aiming to expand their horizons and tap into global markets. For companies looking to scale operations, enhance innovation, or enter new geographical territories, overseas funding offers a wealth of opportunities that can propel growth and ensure long-term success.

Understanding Overseas Funding

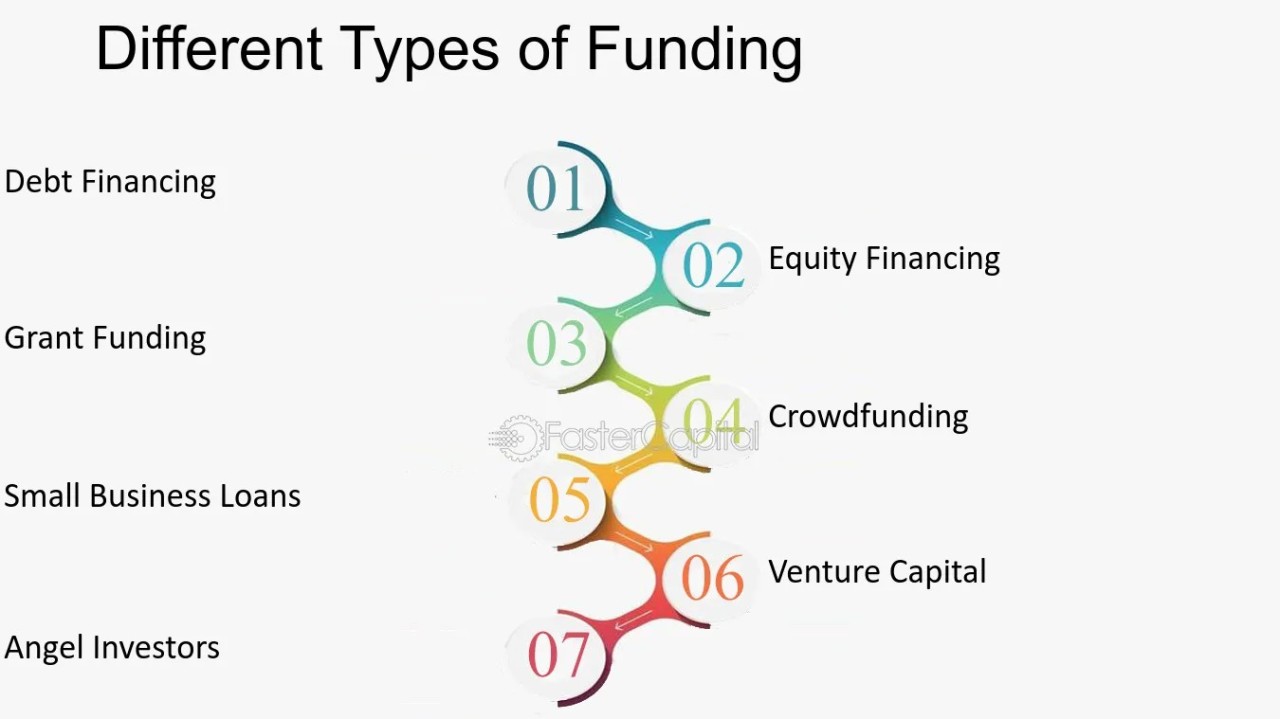

Overseas funding refers to capital investments obtained from sources outside a company’s home country. This can come from various avenues, including international investors, foreign venture capitalists, or global crowdfunding platforms. By leveraging these resources, businesses can access larger pools of capital, diversify their funding sources, and gain strategic advantages that local funding may not provide.

Benefits of Overseas Funding

1. Access to Larger Capital Pools: One of the primary advantages of overseas funding is the ability to tap into larger capital pools. International investors and venture capital firms often have substantial resources that can significantly boost your business’s financial capabilities. This influx of capital can support various growth initiatives, from expanding product lines to entering new markets.

2. Market Expansion and Diversification: Securing overseas funding can facilitate market expansion by providing the necessary resources to establish a presence in foreign markets. With additional funding, businesses can navigate the complexities of international trade, localize their products or services, and build a competitive edge in new regions. This diversification reduces reliance on domestic markets and mitigates economic risks.

3. Strategic Partnerships and Networking: Engaging with international investors through overseas fundingoften leads to valuable partnerships and networking opportunities. Investors from different regions bring unique perspectives, industry connections, and market insights. These relationships can open doors to new business collaborations, joint ventures, and strategic alliances that enhance your company’s growth potential.

4. Innovation and Technological Advancements: Many global investors are keen on funding innovative projects and cutting-edge technologies. By seeking overseas funding, businesses can align with investors who have a keen interest in their specific sector or technology. This alignment can provide not only financial support but also access to advanced research, development resources, and technological expertise.

Strategies for Securing Overseas Funding

1. Research and Target the Right Investors: To successfully secure overseas funding, it’s essential to research and target investors who align with your business goals and industry. Look for venture capital firms, angel investors, or crowdfunding platforms that have a track record of investing in your sector and have experience with international investments.

2. Understand Legal and Regulatory Requirements: Each country has its own legal and regulatory framework for foreign investments. It’s crucial to understand and comply with these requirements to ensure a smooth funding process. Engaging with legal experts who specialize in international investments can help navigate these complexities.

3. Build a Compelling Business Case: When seeking overseas funding, presenting a robust and compelling business case is vital. This includes demonstrating your company’s growth potential, market opportunity, competitive advantage, and financial projections. Clear and persuasive documentation will enhance your credibility and attract serious investors.

4. Leverage Global Networks and Platforms: Utilize global networks and platforms to connect with potential investors. Participate in international business conferences, pitch events, and online platforms that facilitate connections between businesses and overseas investors. Building a strong global network can increase your chances of finding suitable funding opportunities.

Conclusion

Overseas funding presents a transformative opportunity for businesses aiming to scale and succeed in a global marketplace. By accessing international capital, expanding into new markets, forming strategic partnerships, and driving innovation, companies can unlock significant growth potential. However, navigating the complexities of overseas investments requires thorough research, strategic planning, and compliance with legal requirements. Embrace the possibilities that overseas funding offers and position your business for a thriving future on the global stage.